In today’s fast-paced world, securing reliable healthcare is more important than ever. private health insurance offers individuals and families access to faster medical care, wider hospital choices, and tailored coverage that meets personal needs. While public or state-provided healthcare covers basic necessities, private insurance gives you control over your treatment, flexibility in providers, and the comfort of comprehensive benefits. Whether you live in the UK, the US, or Germany, understanding how private health insurance works and its associated costs can help you make informed choices that protect your health and your finances.

What Is Private Health Insurance?

private health insurance refers to healthcare coverage provided by non-governmental insurers that supplements or replaces public healthcare options. Unlike state healthcare plans, private health insurance allows you to choose hospitals, specialists, and treatments. It often covers services beyond standard public plans, including elective surgeries, dental care, maternity, and vision.

Globally, private health insurance differs by region. For instance, private health insurance Germany provides supplemental coverage to the statutory system, while private health insurance Louisiana focuses on individual and family plans that complement Medicaid or Medicare. The flexibility of private insurance appeals to people seeking convenience, reduced waiting times, and enhanced services.

Types of Private Health Insurance Plans

Private health insurance comes in various forms to suit different needs. Understanding these options helps you select the most appropriate plan for your circumstances.

- Individual and Family Plans

Individual plans cover a single person, while family plans provide protection for multiple dependents under a single policy. Family coverage is ideal for households with children or aging parents who require regular medical attention. These plans are often customizable, allowing policyholders to include optional benefits such as dental or vision care.

- Corporate and Group Health Insurance

Many employers offer corporate or group private health insurance to their employees. These plans provide broad coverage at reduced costs, leveraging the group’s collective bargaining power. Group plans may include preventive care, wellness programs, and specialized treatments not always available in individual plans.

- UPMC Private Health Insurance

UPMC private health insurance is a notable example of region-specific coverage in the United States. It offers comprehensive healthcare solutions for individuals, families, and seniors, combining hospital networks with tailored benefits. UPMC plans emphasize flexibility, access to specialized treatments, and personalized customer support.

Cost of Private Health Insurance

One of the most critical considerations for anyone exploring private health insurance is cost. The price of coverage depends on age, health status, location, and the type of plan chosen.

How Much Does Private Health Insurance Cost?

The cost of private health insurance varies widely. Younger, healthier applicants generally pay lower premiums, while older individuals or those with pre-existing conditions face higher rates. Other factors influencing costs include deductible amounts, co-payments, and optional benefits added to the policy. Understanding these variables helps applicants plan their budgets effectively.

Cost of Private Health Insurance in the UK

In the UK, private health insurance provides faster access to treatments outside the NHS system. The average monthly cost ranges depending on age and coverage level. Premiums for individuals typically start modestly but increase with age or additional benefits. Many UK residents opt for private insurance to avoid long NHS waiting lists for elective surgeries or specialist consultations.

Cost Breakdown in the US and States

In the United States, private health insurance costs fluctuate based on state regulations and local healthcare markets. In New York, for example, buyers can compare plans using detailed marketplaces, while Louisiana offers unique individual and family plan structures. Monthly premiums vary significantly depending on coverage level, with high-deductible plans offering lower monthly payments but higher out-of-pocket expenses. Understanding regional variations is key to finding affordable and comprehensive coverage.

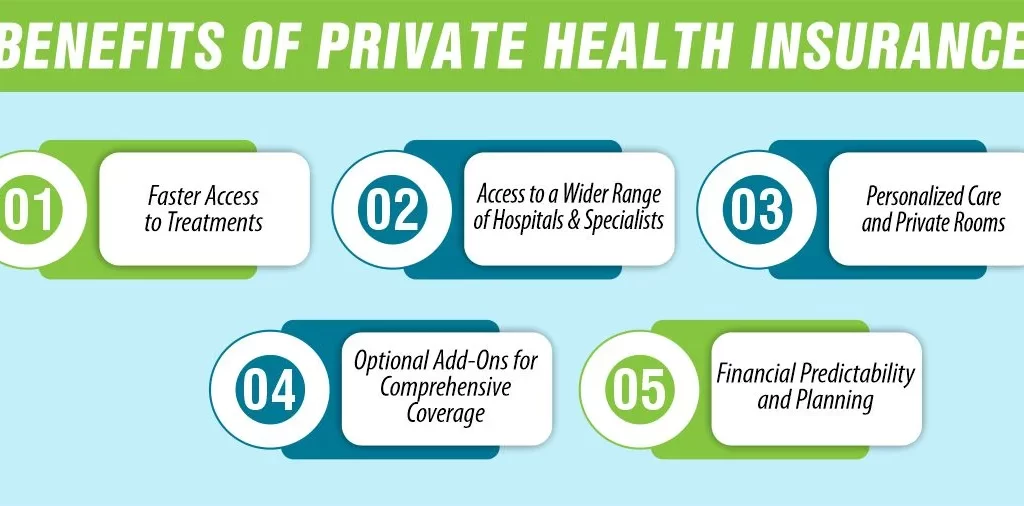

Benefits of Private Health Insurance

Private health insurance offers more than just coverage; it provides faster access to care, personalized treatment, and financial peace of mind. Understanding its advantages can help you make an informed decision.

- Faster Access to Treatments

With private health insurance, patients experience reduced waiting times for consultations, tests, and elective procedures, ensuring timely medical attention.

- Access to a Wider Range of Hospitals and Specialists

Private insurance allows policyholders to choose from a broader network of hospitals and specialists, offering more options than standard public healthcare.

- Personalized Care and Private Rooms

Patients can enjoy private rooms and more individualized attention, enhancing comfort and overall treatment experience during hospital stays.

- Optional Add-Ons for Comprehensive Coverage

Plans often include additional benefits such as dental, maternity, or vision care, providing a more complete healthcare solution.

- Financial Predictability and Planning

Policyholders know their monthly premiums and coverage limits upfront, helping manage unexpected medical expenses and plan their finances effectively.

How to Buy Private Health Insurance

Purchasing private health insurance requires careful consideration of your needs and budget.

Steps to Purchase Private Health Insurance

Buying private health insurance requires careful planning to ensure you select the right coverage for your needs and budget. Here’s a step-by-step guide to simplify the process.

- Assess Your Healthcare Needs and Budget

Start by evaluating your medical requirements, lifestyle, and financial situation. Determine which services you need most and how much you can afford to pay in premiums.

- Compare Policies and Coverage

Review multiple insurance plans, paying close attention to what each policy covers, including any exclusions or limitations. This helps ensure the plan meets your specific needs.

- Check Provider Networks and Support

Investigate the insurer’s hospital network, available specialists, and customer service quality. A strong support system ensures smoother claims and better overall care.

- Explore Online Marketplaces

In states like New York or other regions, use online insurance marketplaces to compare available options, premiums, deductibles, and co-payments. This allows you to make an informed, cost-effective choice.

Choosing the Best Private Health Insurance

Selecting the best private health insurance involves balancing cost, coverage, and service quality. Consider optional benefits, waiting periods, and provider reputation. Comparing policies from multiple insurers allows you to find the plan that aligns with your personal and family needs.

Conclusion

private health insurance empowers individuals and families to access timely, high-quality medicare while reducing financial uncertainty. By providing flexibility, comprehensive coverage, and faster treatment options, private health insurance ensures peace of mind. Whether you live in the UK, US, or Germany, exploring available plans, understanding costs, and comparing benefits helps secure a policy that meets your needs. Protecting your health and your family’s future begins with selecting the right private health insurance plan.

Compare plans and get your personalized health insurance quote today with DreamHealthQuotes!

FAQs About Private Health Insurance

What is covered in private health insurance?

Private health insurance typically covers hospital stays, specialist consultations, elective surgeries, maternity care, dental, and vision services, depending on the plan.

What is the minimum cost of health insurance?

The minimum cost varies by location, age, and plan type. High-deductible or limited-coverage policies often offer lower monthly premiums.

Which private health insurance is best?

The best plan depends on individual needs, budget, and location. Factors like coverage, network access, and customer service quality should guide the choice.

What is the best age to get health insurance?

Purchasing private health insurance at a younger age generally results in lower premiums, but it is advisable to secure coverage before health conditions arise.

What are the top 3 health insurances?

Top health insurance providers vary by region. In the US, companies like UPMC, Blue Cross Blue Shield, and UnitedHealthcare are widely recognized, while the UK and Germany have their own leading insurers.